Bitcoin is the first ever cryptocurrency to be created, and after its release, an entire market of thousands of altcoins and other “virtual currencies” have been created.

Bitcoin is valuable because people have decided it is, and are willing to exchange money for the rare cryptocurrency. But because Bitcoin is unlike any other asset before it, currently isn’t heavily in use, and is more of a speculative asset where people are investing in possible potential outcomes, it is difficult to define exactly what the valuation of each Bitcoin should be.

The free and open crypto market decides the current price of Bitcoin through the tug of war-like action between buyers and sellers. As buyers and sellers battle it out on cryptocurrency exchanges, it causes price fluctuation. If sellers dominate price action, then the price per BTC goes down. If buyers begin to outweigh sellers, this causes demand to outpace supply, and price appreciates instead. When both forces are nearly equal, it results in sideways trading action or a lack of volatility.

What Is Bitcoin Volatility?

Bitcoin volatility is the measure of all price fluctuations to either side within a certain timeframe. If Bitcoin price is trading sideways because buyers and sellers are near equilibrium, this would result in low volatility. Phases of such nature are rare in Bitcoin and other cryptocurrencies, which typically experience wild price swings in either direction.

Bitcoin volatility and in other cryptocurrencies compared to other markets exhibit notable differences. Even when the stock market, using the Dow Jones Industrial Average as an example, is at its most volatile, the market corrected only 30%. Meanwhile, during the same timeframe, Bitcoin volatility was significantly higher, resulting in a correction of a much higher magnitude and percentage. Other cryptocurrencies are even more volatile than Bitcoin.

The volatility of Bitcoin and the resulting Bitcoin price fluctuation isn’t necessarily a bad thing, however. Volatility doesn’t always resolve to the downside, and it is volatility that is responsible for Bitcoin’s rise from $4,000 to $50,000 from 2020 to 2021. With Bitcoin volatile in this manner, it also makes it a great digital asset for traders and not just holders, as they can profit from the price action in between each major swing.

Why Does Bitcoin Fluctuate So Much And So Often?

Here are some of the most critical factors influencing Bitcoin price fluctuations.

Speculative Asset

More than any other reason and all other reasons combined, because Bitcoin is so subject to speculation, it is especially susceptible to changes in market sentiment. This causes trends to be especially powerful, and tend to overextend. Uptrends often result in hundreds of thousands of percentage increases, while a downtrend can wipe out as much as 80% or more of the gains from the previous bull cycle.

The reason for this is because no one knows what each Bitcoin should be worth, nor is it in heavily enough use to understand what applications it can ultimately have for everyday life. Bitcoin volatile as it is currently makes it unsuitable to use as a currency for daily transactions, which pundits often criticize the coin over. Instead, Bitcoin is being used as a speculative store of value, with an ultimate goal of some day being used as a currency.

Bitcoin will either succeed and eventually replace the dollar as the global reserve currency, or it could become a complete failure, for example, if a major vulnerability is discovered. Therefore, when sentiment shifts, it tends to shift towards extremes, and price action follows.

Market Size

The overall market size compared to other assets is also a reason for the massive volatility in Bitcoin. The market capitalization of Bitcoin is roughly $1 trillion, compared to gold at $10 trillion is tiny in size. The lower amount of liquidity makes price fluctuations that much larger on the price chart.

There are also only 21 million BTC, which has made the asset heavily sought after for a hedge against inflation. But at the same time, the small amount of coins means that any capital that comes in is distributed across a tiny amount of shares per coin, making the market cap and price per coin rise and fall rapidly.

Regulation

At some point, governments could step in to more firmly regulate Bitcoin. The current lack of regulation does contribute to Bitcoin volatility, in a sense that there is always a layer of fear that something could happen with laws pertaining to the ownership of Bitcoin.

Without real regulation, there’s risk of market manipulation that also causes greater than otherwise price movements.

Global, Always On Market

Another factor that makes Bitcoin volatile, is the fact that the market is always on, and reaches globally.

The United States and Europe make up the largest share of investors in cryptocurrencies, but because the market stays on after hours in these countries, trading volume diminishes, order books are cleared, and it offers a prime opportunity for whales to strategically manipulate the price action. In a later example, a coordinated buy on multiple platforms in the middle of the night caused the first major breakout from Bitcoin’s bottom, demonstrating this exact factor.

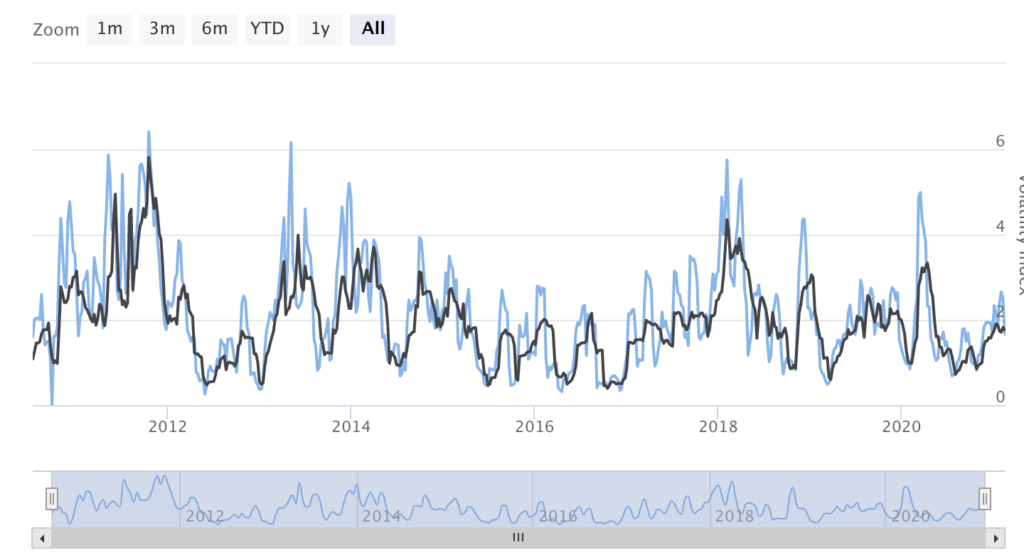

What Is the Bitcoin Volatility Index?

The Bitcoin Volatility Index, also called BVI or BVOL, is a graph that measures the intraday price fluctuations of Bitcoin price in relation to the actual price of the asset. According to the index, the higher the index goes, the more volatile Bitcoin is and the riskier it is as an investment due to how unpredictable price action can get at that stage.

The Most Remarkable Bitcoin Price Fluctuations In Cryptocurrency History

If you want to get a glimpse at how profitable Bitcoin has been historically due to its volatility, then review the Bitcoin price chart dating back to past bull markets and bear cycles.

The first major price fluctuation took place after the cryptocurrency’s first block reward halving. It led to two major bullish impulses, each rising 1700%. When it was all said and done, however, Bitcoin crashed by roughly 85%.

After Bitcoin crashed, and formed a base, another 12,000% rally took place. Much like the last time around, Bitcoin crashed again to roughly 85%. Bitcoin price action goes parabolic with each bear market cycle.

The below example was introduced earlier in this guide. After peaking at $20,000, Bitcoin dropped 85% to $3,000, then climbed to $13,000, only to fall back to $3,000. Now Bitcoin is at $50,000 and more.

Bitcoin volatility doesn’t always take place across higher time frames like weekly and monthly. Large moves can even happen in just a matter of days, or even in a single day, as each 40% rise and fall shows below.

The Best Strategies To Benefit From Bitcoin Volatility

As you can see in the historical examples above, Bitcoin price volatility can be extremely profitable, or painful, depending on if you are a holder or a trader. Here we’ll explain the benefits between the vastly different strategies investors can use to take advantage of bitcoin price fluctuations.

HODLING

Holding also called HODLING through bull and bear markets is the easiest strategy of all, but is the least profitable overall and the most painful. Those that held too long at the top of the 2017 rally, saw their investment fall from $20,000 to $3,000. From there, Bitcoin went to $13,000, then back to $3,000 again. The cryptocurrency now trades at prices more than ten times that, so holders prevailed in the end, but it took four years and many downtrends before price action turned upward again.

Buy Low, Sell High

Had those holders sold their Bitcoins at the peak and re-bought lower, they would have had multiple opportunities to increase their cash holdings and Bitcoin holdings concurrently. Bear markets are ideal for this.

Day Trading

Day trading involves using a small portion of a Bitcoin stack to take intraday positions on smaller price swings. This in-and-out trading action can be profitable, and lets holders continue to have a larger stack of spot BTC.

Swing Trading

Swing trading takes a larger amount of BTC on trade to make a difference, and takes tons of patience. Swing trades aim to time tops and bottoms with some degree of accuracy, and hold the positions for a period of weeks to potentially months before closing. Trades of this manner tend to be more profitable, but more challenging for timing.

CFD Trading

CFD trading is possible on a margin trading platform like FlowMarketPro. CFD trading lets users trade Bitcoin-based contracts, from a BTC-based account. This way, users will hold spot BTC, while trading Bitcoin to maximize profit opportunity with day trading or swing trading strategies.

Conclusion: Trade Bitcoin Volatility With FlowMarketPro

Bitcoin’s notorious volatility is both a blessing and a curse all in one. Those that consider holding through it, will have to suffer and stomach all of the ups and downs in between each major bull and bear cycle. Those that hold through it are ultimately rewarded, but in the end could always have made a lot more money off Bitcoin by trading instead.

Bitcoin’s volatility poses a once-in-a-lifetime opportunity to trade the asset back and forth, growing cash capital and BTC holdings at the same time. By holding spot BTC on an award-winning platform like FlowMarketPro, investors can instead trade Bitcoin-based contracts on Bitcoin and other cryptocurrencies, and profit from the price fluctuations that take place naturally during the days, weeks, and months.

FlowMarketPro offers technical analysis software and other tools that help traders get a read on where Bitcoin will go next, so they can maximize the money made on each price swing.

Margin trading accounts on FlowMarketPro are free for anyone, and takes only a few minutes to get signed up and begin trading. Any deposits that are made, can be multiplied using leverage and Bitcoin CFDs for massive positions sizes and even more opportunity.

Bitcoin CFDs range across cryptocurrencies like Ethereum, Bitcoin, Litecoin, and EOS, while traditional assets vary from forex, commodities, stock indices, gold, oil, and many more.

Why Is Bitcoin So Volatile?

Bitcoin is volatile due to its smaller market size, sentiment changes, speculation, regulatory factors, and much more.

How Is Bitcoin Volatility Calculated?

Bitcoin volatility is calculated by taking the daily price, and measuring the daily price fluctuations in relation.

What Time Of Day Is Bitcoin The Most Volatile?

There is no specific time that is more volatile than others. However, low volume during late hours of the nights and weekends can result in more volatility. But this is not always the case.

How Fast Does Bitcoin Price Change?

Bitcoin price changes by the second or minute, and is always changing. Every time a sale of Bitcoin is made on any exchange anywhere in the world, the price of Bitcoin fluctuates.

What Makes Bitcoin Go Up Or Down?

The push and pull of buyers and sellers is what makes the price of Bitcoin go up and down. When there’s more buyers than sellers, it goes up. When there’s more sellers than buyers, it goes down. It’s that simple.

What is the Bitcoin Volatility Index?

BVOL is a graph that measures the daily price fluctuations of BTC. The higher the index goes, the more volatile Bitcoin is and the riskier it becomes.