Forex trading is the exchange of currencies. The Forex market is one of the biggest in the world, as it facilitates the ability to make cross-border payments. The retail trader tries to buy one currency with another, hoping that the currency they bought appreciates.

All trades are always done in “pairs”, which means exchanging one currency for another, such as the Euro for the US Dollar. If you guess the direction of the market correctly, you can benefit from price changes.

There are different groupings of currency pairs that you can speculate on. Below are the categories you may choose to be involved in.

- Major pairs: This is roughly 80% of the trading volume daily. These pairs all include the US dollar. This includes the Euro vs. US dollar (EUR/USD), US dollar vs. Japanese yen (USD/JPY), British pound vs. US dollar (GBP/USD), US dollar vs. Canadian dollar (USD/CAD), US dollar vs. Swiss franc (USD/CHF), Australian dollar vs. US dollar (AUD/USD), and New Zealand dollar vs. US dollar (NZD/USD).

- Minor pairs: These pairs include a mix of the major currencies, but without including the US dollar. A few examples include EUR/GBP, EUR/JPY, GBP/CHF, and so on.

- Exotic pairs: This is when a major currency is matched against one from a smaller economy, such as US dollar vs. Polish Zloty (USD/PLN), Euro vs. Mexican peso (EUR/MXN), or South African rand vs. Japanese yen (ZAR/JPY).

- Regional pairs: These pairs are defined by the region they both belong to. For example, Euro vs. Norwegian krone (EUR/NOK), AUD/NZD, or Singapore dollar vs. Japanese yen (SGD/JPY).

What is The History of Forex Trading?

After World War 2, there was an agreement known as the Bretton Woods accord. It was the way that currencies we related to each other, essentially based upon the US dollar as being worth a set amount of gold. (1 ounce of gold = $36.) However, in 1971 this agreement began to fall apart when US President Richard Nixon took the US “off of the gold standard.”

Most currencies were allowed to freely float against each other after this move, and such fundamental factors as supply and demand came into play. The amount of a currency in circulation also began to play a key role in its value as well.

The large commercial and investment banks do most of the trading in the Forex markets on behalf of clients. However, as time went by, speculation became more and more common.

Currencies have an interest rate differential that comes into play as well. Buying the currency with the higher rate of interest attached to it against one with a lower rate is one way traders make money, beyond simple price appreciation.

How does forex trading work?

Forex trading takes place between two parties in over-the-counter markets. This means that the markets are not centralized like a stock market would be. The global currency markets are run by a group of banks and other organizations known collectively as the “Interbank market.”

The transacting of business is spread out across the world and in all time zones. Because there is no central exchange, it is open 24 hours a day, as dealers are operating in various time zones such as Tokyo, New York, Frankfurt, London, and so on.

Most Forex traders don’t take actual delivery of currency that is bought or sold. The traders are betting on price fluctuations to benefit financially from the market. The trader will perhaps decide that the value of the British pound is going to rise against the US dollar, and buy the Pound, whilst selling the Dollar.

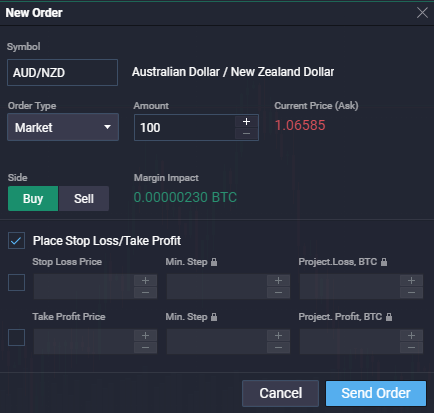

The platform that traders use at FlowMarketPro allows them to speculate on the future movement of these pairs of currencies, without the complexities that would be necessary for the direct Interbank market.

What Are the Types of Forex Markets?

While retail traders typically only trade one type of foreign exchange market, there are three that exist.

- Futures Forex market: These are exchanged traded contracts to buy or sell a standardized amount of a currency at a set price at a date in the future. Retail traders make up a small portion of this market.

- Forward Forex market: This is a contract that is an agreement to buy or sell a set amount of a currency at a specific price, and to be settled at a specific date, or range of dates. This is almost always done by corporations or financial institutions.

- Spot Forex market: This is the market that most retail traders are involved in. It is the simple transactions of currency “on the spot” or exchanged at the current rate. This is the market that CFD trading or over-the-counter derivatives that are offered by FlowMarketPro are based upon. This allows the trader to get in and out of the market easily and quickly.

How Forex Trades Are Quoted

Foreign exchange pairs are quoted with a base currency and a quote currency. The base currency is the first of the pair, while the quote currency is the second. In other words, you are quoting the first currency in terms of the second one. (You do this all the time, but probably haven’t thought about it. Think of a share of Walmart stock. The price is being quoted in dollars. In a sense, it is the same as quoting WMT/USD.)

If you have the currency pair EUR/JPY in focus, the EUR, or Euro, is the base currency. The Japanese yen is the quote currency. If the pair is trading at 131.12, then one Euro is worth 131.12 yen.

If the Euro rises against the yen, then a Euro will be worth more, and therefore the price will increase as a quote. Conversely, if the Euro losses strength, then it will be worth fewer yen, and the quoted price will fall.

What exactly moves the forex market?

To benefit from the foreign exchange markets, you will need to have an idea of what moves them. Some very common factors are behind most price moves. Once you understand these factors, you greatly increase your chances of being successful.

Central banks

The supply of a nation’s currency is controlled by the central bank of that country. They will either increase the monetary supply or decrease it. They will also do asset purchases, such as buying local bonds to influence the interest rate that sovereign debts can offer.

Interest rates will greatly influence how much borrowing, and therefore growth, in an economy is happening. Central banks will either try to stimulate growth or slow it down to keep a balance and sustainability to the economy.

News reports

Institutional traders will want to invest in economies that are growing. They will look to buy assets in those countries, and this can move the flow of currency across borders. If the economy in Australia is strong, while the economy in Canada is weak, then it makes sense that the Australian dollar should strengthen against the Canadian dollar.

Multiple news reports reflect what is going on in an economy. These are used as a gauge on relative strength or weakness. Some of the most commonly followed ones are the following:

- Central interest rate decisions

- Employment figures

- GDP

- Retail sales

- Inflation figures

Market sentiment

Market sentiment can come into play when it comes to FX trading as well. This is essentially how traders “feel” about growth prospects and whether there is demand for further investment. This is often a reaction to some kind of news headline or economic event.

As an example, commodity-based economies tend to do well in inflationary environments. (To a point.) If commodities are rising in price, it stands to reason that those currencies such as the Australian dollar, New Zealand dollar, and Canadian dollar attract a certain amount of interest because of it, as they are major commodity exporters.

Conversely, if commodities are dropping and people are worried about the ability of the global economy to grow, they may rush into “safety currencies” such as the US dollar, Swiss franc, or Japanese yen.

Inflation rates

Inflation in an economy can have a significant influence on what happens with the currency, and therefore Forex traders tend to pay close attention to it. While inflation is not the only factor that drives price, it is one of the biggest.

Significant inflation is likely to hurt a currency’s value and exchange rate. While a low rate of inflation does not guarantee a favorable exchange rate for a country, inflation running hot does tend to express a potential need for the central bank to slow the economy down. They do so by monetary tightening, thereby slowing down lending and investment.

Terms of trade

Terms of trade are most often expressed as a percentage and measures export prices against import prices. The calculation goes as follows:

100 * export prices / import prices = terms of trade

The calculation is different than the trade balance measurement, as it only considers the aggregate price index and ignores volume. An economy that exports gold at $1500 an ounce would have an export price index of $1500, regardless of the amount.

If this country is trading with another one that sells oil at $100 a barrel, then the terms of trade between the two countries would be a ratio of $1500 / $100, multiplied by 100, which equals 1,000%. Simply put, for each ounce of gold exported, the country can import 10 barrels of oil.

In the real world, economies don’t only export one product, so it is calculated as a total of all exports and imports. The result is when they export more than they import, it creates a surplus. When they import more than they export, it creates a deficit.

Debts

A heavily indebted country typically doesn’t perform as well as a country running a surplus. As a result, the investment will often look to those countries to expand. This causes demand for the local currency as a function of this action. However, if the country is highly indebted, this can have the opposite effect.

What Are the Advantages of Forex Trading?

The advantages of Forex trading are numerous, to say the least. One of the most important benefits is that the Forex markets are open 24 hours a day. This allows for almost anyone to get involved in trading, no matter their schedule.

The Forex markets also focus on national currencies, meaning that there aren’t as many securities to follow. As opposed to stock markets, traders can do quite well by simply understanding a handful of currencies known as majors.

The markets are also very technically driven. The retail trader tends to focus more on technical analysis, or chart reading, than fundamentals, so many find that Forex trading makes more sense. Also, there are some economic announcements to pay attention to, the data is far less involved than doing fundamental research on a specific company.

The ability to tailor the size of your trade is a huge advantage. This means that traders from all over the risk spectrum can get involved. By using our CFDs at FlowMarketPro, you can trade in small sizes, and build up your trading positions over time.

What Are the Drawbacks of Forex Trading?

Forex can have drawbacks for some traders. The most obvious concern is the use of leverage, which is when you borrow money to control a bigger position than you normally would. If not used professionally and responsibly, leverage can be dangerous.

Another concern about the markets is that they are open 24 hours a day, which means that if you do not protect your account, news that comes out while you are sleeping can cause losses. However, using a stop loss and money management is the solution.

Forex Terms You Need to Know

As with any profession, there is a certain amount of jargon you will have to understand. The FX markets have a handful of unique features that all should be understood before placing your first trade. The unique nature of these markets is a major benefit if you know how to navigate the landscape.

Leverage

One of the biggest advantages to trading the spot Forex market is leverage. Leverage is borrowing a certain amount of funds from your broker to control a larger portion of currency than you normally would be able to.

FlowMarketPro allows traders to trade up to 100 times larger than your initial deposit for the position, increasing the ability to profit. However, you should keep in mind that leveraged trades can also work against you, as both gains and losses will be magnified.

Risk management is crucial when using leverage, but professional traders learn to take advantage of it. All of this is done underneath the hood, as the platform does all of the financial work behind the scenes. It is simply a matter of buying or selling by clicking a few buttons.

If a trade goes in your favor by 3%, you could see a 300% profit using 100 times leverage. However, you can also see the same type of loss. Because of this, you must never use 100% of your available leverage. A good expression to remember is “A little bit goes a long way.”

Margin

Margin is a crucial part of leveraged trading. The term “margin” refers to the original deposit of capital that you put up to open a position. FlowMarketPro then will loan you the rest of the necessary capital to open up a bigger position. FlowMarketPro’s platform will do all of this under the hood for you, so there is no need to be concerned with doing calculations.

That being said, you must understand that taking control of a bigger position than you would otherwise be able to do offers not only bigger gains, but also potentially bigger losses. Because of this, once the margin isn’t enough to cover the credit risks, FlowMarketPro will close the position automatically to protect your account.

Pip

A “pip” stands for “percentage in points”, and is the unit used to measure a currency’s movement. The pip is usually the fourth decimal place of a currency pair, except those that only have two decimal points, i.e., the yen-related pairs. If the GBP/USD pair moves from 1.31112 to 1.31122, that is a one pip move. If the USD/JPY pair moves from 114.14 to 114.15, that is also a one pip move. Each pip is considered to be 1/100th of a percent or one basis point.

Spread

When trading markets, there much be an agreement on price. The spread in the Forex markets represents the price that sellers are willing to sell a pair, as well as what the buyers are willing to pay. The “bid” is what buyers are offering sellers, while the “ask” (sometimes called “offer.”) is what sellers are asking for a pair. Sooner or later a trader will accept the price that others are offering.

The spread can change, based upon at what prices people are willing to transact. This will change and fluctuate on liquidity as well, as sometimes the markets have much more volume than others.

Lot

A “lot” in the Forex world is a standardized unit of measure. It is 100,000 units of a currency, so when a trader states that they are “buying 1 lot of EUR/USD”, they are buying 100,000 Euros. The trader could also say that they are “shorting 5 lots of GBP/USD”, which would mean that they are selling 500,000 British pounds.

You do not have to trade a standard lot. Many trades are done with 0.1 lots, 0.02 lots, and so on. Most traders will look at their account to determine proper position sizing, and trade accordingly.

Forex Trading Strategies

Forex markets have a few basic trading strategies that you should be aware of. Traders can either be long or short a currency pair. In a long trade, they are betting that the currency price will increase in the future, and they will be able to collect profits. In a short trade, they are betting that the currency price will decrease over time, offering profits as well.

There are four basic types of trades:

- Scalping: Scalping is a trading style in which the trader holds on to a position for seconds, maybe minutes at the most to profit from very short-term moves.

- Day trading: Day trading is trading for short-term moves where the position is opened and closed during the same trading day. The duration of one of these trays could be hours or minutes and is normally based upon technical analysis.

- Swing trading: Swing trading is when a trader holds a trade for more than a day, perhaps multiple days or weeks. Swing trades tend to be based upon larger support and resistance levels, as well as major economic announcements.

- Position trading: Position trading is when a trader holds a currency pair over a long period, perhaps months or years. This is to take advantage of longer-term trends.

What Charts Are Used in Forex Trading

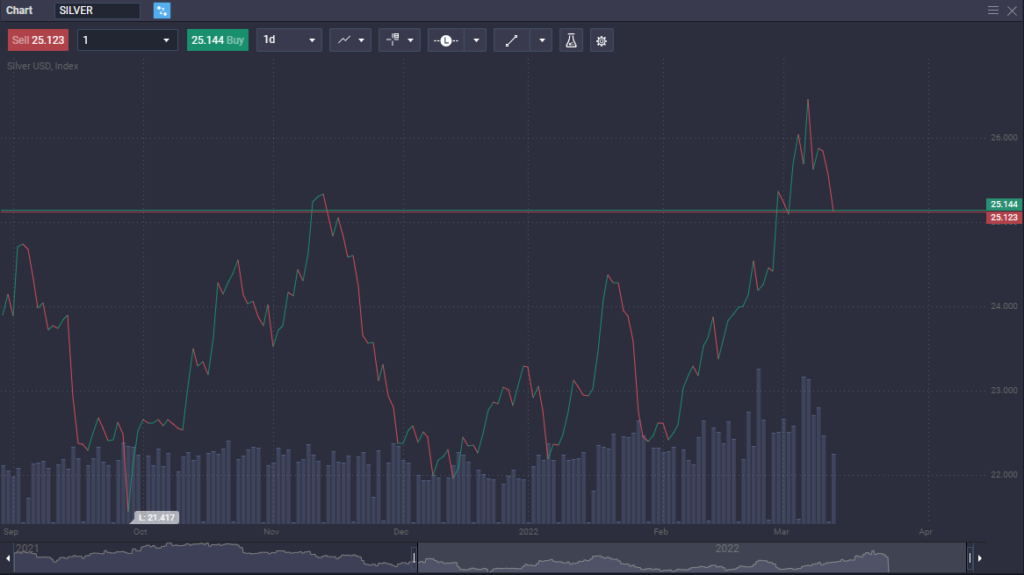

When trading Forex, traders have choices on how to chart the markets. The most common three types include line charts, bar charts, and candlestick charts. Each has its use and will be used in different situations. The ability to understand trends, potential reversals, and breakouts via charts is a necessary skill for successful trading.

Line Charts

Line charts are the most basic of chart types. They are simply a line that shows the closing price over a longer-term timeline. They typically are used for identifying trends, as well as support and resistance. The line chart is also good for determining the most significant trendlines as well.

Bar Charts

Bar charts are used to represent specific segments of time for the trader. They offer much more analysis of the specified time than a simple line chart, as they plot the open, high, low, and closing prices for a unit of time, such as a week, day, or hour. These bars are sometimes referred to by their acronym, OHLC.

Some bar charts will also be color-coded. These will often be green bars for a rising price, and red for closing, although – they can be any color the trader chooses to use. The bar chart is a significant step forward for traders to understand the movement of the markets.

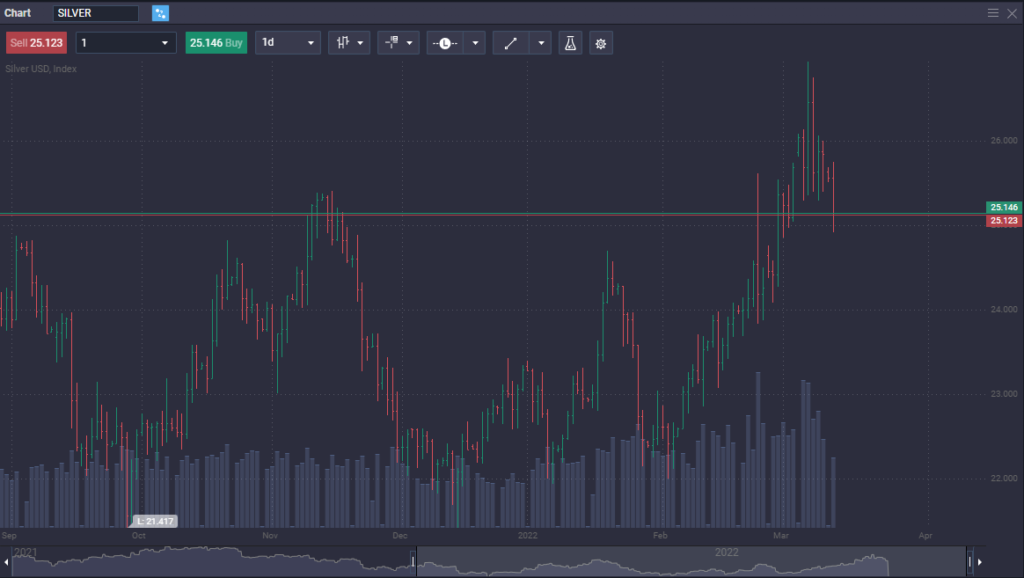

Candlestick Charts

Candlestick charts are sometimes referred to as “Japanese candlesticks”, as they have been in use for centuries in that country. Originally used to track the rice markets, they have become popular with western traders over the last few decades.

They are easier to read than many other types of charts, as they begin with color-coding. The candlestick will be one color for rising prices, normally green or white, and another for falling prices, typically red or black.

The candlestick has a body and wicks both above and below that body. The “body” of the candle will tell you the opening and closing price and is colored according to the timeframe either being a rise or fall in price. The body can have wicks on the top and the bottom of the body if the highs or lows extend past the opening and closing price.

A quick scan of the charts can tell the trader whether the trend is strong, as a long section of red candles could suggest a lot of selling pressure, or a long run of green candles could suggest a rising trend. Furthermore, candlesticks have a plethora of shapes that can be used to predict price movements. Some of these are known as shooting stars, hammers, Doji candles, bullish engulfing candles, bearish engulfing candles, and numerous others.

Conclusion

Forex trading is a great way to trade the international markets, as no matter the asset, any cross-border transaction will be influential in FX. The ability to focus on large economies instead of individual companies makes trading Forex superior to trading stocks as an example.

The Forex markets also offer a lot of additional benefits such as interest being earned, 24-hour market access, and large amounts of liquidity. This allows the trader to get in and out of positions quite easily. The FX markets are some of the most liquid markets in the world.

The retail spot Forex markets at FlowMarketPro are traded via CFD, or contract for difference pairs, meaning that you can trade the pairs in very granular position sizes. This makes the market great for smaller accounts, as well as novice traders. The flexibility is by far one of the biggest attractions.

While chart patterns aren’t necessarily 100% accurate, it is worth noting that the Forex markets do tend to trade well with technical analysis overall and the competent chart reader can do quite well as a result.

Is forex trading good for beginners?

Forex trading certainly can be a good choice for beginners. The fact that you are looking for large economies, and the amount of currencies is somewhat limited, makes trading FX a great choice, the ability to trade small position size is also a major advantage.

Why forex is a bad idea?

It isn’t that Forex is a bad idea per se, just that many traders do not take the proper risk management precautions to benefit from this highly liquid and massive market. It is like any other market; you must have your strategy in focus and stick with it.

Is forex trading illegal?

No. In almost all countries on earth, FX trading is perfectly legal. If you have questions, you should look to your local regulatory agency to make sure.

Is forex really profitable?

If you practice money management, a robust strategy, and common sense, Forex trading can be very profitable. However, there is no guarantee that every trade you take is going to be a profitable one, no matter how good you become at it.

Is it better to invest in stocks or forex?

There is no “one size fits all” answer to this question. The best answer is that currency trading can be a great addition to your portfolio, but you need to understand the market that you are trading. Forex has a lot of advantages to stock trading, but both can be beneficial.