Trading on margin allows you to control a large amount of capital without having to deposit the capital into your trading account. Depending on the leverage ratio you want to use, you can open a crypto trade that’s multiple times larger than your trading account balance. Let’s see how margin trading works.

What is Cryptocurrency Margin Trading?

Trading on margin, also known as trading on leverage, involves borrowed money that is used to trade a financial instrument, such as a cryptocurrency. That loan is made available by your broker and requires collateral, which is called a margin, in trading circles.

The required amount of margin depends on the leverage ratio you want to use in your trades, and you always need to have enough free margin in your account to withstand the negative price fluctuations of your leveraged trades.

The reason for this is simple: your free margin depends on the unrealized profits and losses of your open crypto trades. Unrealized profits increase the available margin in your account, while losses reduce it. This may sound complicated at first, but by the end of the article, margin trading will be crystal clear to you.

Why Trade Crypto on Margin?

Trading on margin is extremely popular among retail traders as it allows for a significant market exposure with a relatively small trading account. Margin trading has been popular in other markets as well, such as forex for example, and cryptocurrencies are no exception.

So, why would a trader want to trade on margin? Here are our top two reasons.

- Higher profit potential – Margin trading allows traders to control a large sum of money, which in turn significantly increases the profit potential – even on small price movements. However, potential losses are magnified as well.

- Risk management – When done right, losses on leveraged trades can always be kept under control, given good risk management practices. Margin trading can also help you to better understand risk in the financial markets.

How Does Margin Trading Work in Cryptocurrency?

Margin trading in cryptocurrencies works just like in other financial markets – a trader borrows money from his or her broker in order to fund a crypto trading position. In order for this to work, the broker requires small collateral for the loan, which can be as low as 1% of the position size in case of a 100:1 leverage ratio.

Let’s say you want to buy $100,000 worth of bitcoin but only have $2,000 in your trading account. With a 100:1 leverage, the required margin would be 1% of your position size, i.e. $1,000 (1% * $100,000). The remaining $1,000 in your account can be used to open additional trades.

You need to have enough funds in your crypto trading account to cover the margin amount, and also some additional funds that form a buffer in case the leveraged trade starts to go against you.

This means, you should never allocate your entire trading account to the margin, as even small price movements against your favor can lead to the infamous “margin call.”

You’ll receive a margin call if your free margin (i.e., your trading account balance – used up margin) falls below a certain threshold, in which case you’ll be asked to deposit additional funds if you want to keep your trades open.

Cryptocurrency Leverage Trading Explained

Margin trading allows you to magnify your potential profits when the market goes in your favor. However, it also increases your potential losses when the price of a cryptocurrency doesn’t perform as expected.

Here is an example of margin trading in the crypto market. Let’s say you’re trading with a $5,000 account and with a 100:1 leverage ratio. This means you’ll have to allocate a margin that is equal to 1% of your desired position size.

To simplify, let’s say that Bitcoin trades at $50,000. To buy an entire Bitcoin, you’ll have to allocate only 1% of the trade as the collateral (margin) for the trade. The remaining 99% of the required funds will be made available by your broker as a loan.

If Bitcoin rises to $60,000, you would make a profit of $10,000, while only using $500 of your trading funds as the margin for the trade. As you close the trade, the margin is automatically returned to your account balance. After all, it only acts as collateral for the funds borrowed from your broker.

What are the Pros and Cons of Cryptocurrency Margin Trading?

Trading cryptocurrencies on margin can be very profitable if you understand the risks and challenges of leverage. As explained earlier, leverage and margin trading amplifies both your profits and losses. Here are some of the most important pros and cons of margin trading.

The Pros of Margin Trading Cryptocurrency

- Leveraging your buying power. With margin and leverage, you are able to significantly leverage your buying power. The leverage ratio, as offered by your broker, defines how large this increase in buying power is. With a leverage of 10:1, you’re able to control $100,000 with a $10,000 account. Rise that leverage to 100:1, and you’re controlling $1 million with a trading account of only $10,000. Margin trading is an extremely powerful weapon in your trading arsenal.The following table shows how much margin you need to allocate depending on the leverage ratio you’re using.

| MARGIN REQUIRED | LEVERAGE RATIO |

| 5.00% | 20:1 |

| 3.00% | 33:1 |

| 2.00% | 50:1 |

| 1.00% | 100:1 |

| 0.50% | 200:1 |

| 0.25% | 400:1 |

- Profiting from falling prices. Since leverage is widely offered with CFDs, this means that you can profit not only from rising prices, but from falling prices as well. Add to this the ability to control a large sum of capital, and you’re fully prepared for both bull and bear markets.

- Diversifying a portfolio. Last but not least, increased buying power can also be helpful to diversify your crypto portfolio. Instead of putting too many eggs in one basket, you can diversify across many cryptocurrencies while only allocating the margin upfront.

The Cons of Margin Trading Cryptocurrency

- Higher potential losses. The most notable disadvantage of trading on margin is the possibility to face high losses. Leverage and margin trading can work both for and against you. And since you can’t tell with certainty what the market will do, you need to be prepared (and control) potential losses.

- Margin call. Another drawback of margin trading are margin calls. You’ll receive a margin call when your free margin falls below zero. However, the good news is that you can reduce the likelihood of margin calls from happening with efficient risk management.

- Owing interest. Since margin trading is based on a loan provided by your broker, you’ll have to pay interest on the loan if you plan to hold your position overnight. Fortunately, interest rates on margin trading (financing costs) are often extremely low.

Tips for Cryptocurrency Margin Trading

When trading on margin, it’s important to fully understand the risks and benefits of leverage and to actively control your risk levels. In the following lines, we’ll provide detailed tips on margin trading, so that it impacts your bottom line in a positive way.

1. Don’t overtrade

The most common mistake when trading cryptocurrencies on margin is to overtrade. Overtrading means opening trading positions out of the risk boundaries that you’re able to manage. It’s easy to fall into the trap of trading on very high leverage ratios which can push your trading account over a cliff.

2. Respect your risk management rules

Besides overtrading, many traders make another rookie mistake by not defining or respecting their risk management rules. As a rule of thumb, you should not risk more than 2% of your trading account on any single crypto trade. This will help you stay in the game even if you encounter a series of losses.

3. Actively monitor your leveraged trades

Trades that are very leveraged can cause significant damage to your trading account. Even a small price movement that goes against your favor can completely wipe out your account if you overtrade. That’s why you always need to keep an eye open on your active trades.

Plus, unrealized profits and losses directly impact your free margin, which can eventually lead to a margin call if your free margin falls below a certain threshold.

4. Don’t neglect market fundamentals

Let’s face it, we all like technical analysis. However, price movements are often primarily influenced by market fundamentals, which is why you should always have them on your radar. Before placing a leveraged trade, check how correlated markets are performing, such as equities or interest rates.

5. Pay attention to important technical levels

Even though prices are often influenced by fundamentals, technical levels are important too. Big traders often place large orders around important psychological price-levels, such as $1,000, $10,000 or $50,000. When those levels break, we can expect strong trading activity on either side and prepare accordingly.

6. Don’t trade against the trend

Another common mistake among crypto traders is to trade against the trend. This can be especially painful when trading on margin, as every price movement gets amplified by the leverage. Don’t trade against the trend. Buy during uptrends, and sell during downtrends.

7. Understand the cycles of the crypto market

Just like any other financial market, cryptocurrencies move in cycles. When global economies are booming, investors and traders tend to prefer stocks and commodities. However, when interest rates are low, cryptocurrencies become an attractive place to park money, which often leads to long-lasting bull markets.

8. The market doesn’t owe you anything

When you feel like revenge trading, always remember this point – The market doesn’t owe you anything. When you get stopped out of a leveraged trade, there is no need to immediately put another trade in the opposite direction. Most of the time, you’ll get stopped out again. Take a break and reassess your trading plan and market conditions.

9. Learn how to scale in and out of trades

Scaling in and out of trades is a powerful technique that can help you keep losses low and profits high. The main rule is to scale in only into profitable trades and to scale out only out of losing trades. You want to add to your winners and to cut your losers short. How much you’re going to add to your trades is up to you and your trading plan.

10. Always use stop-losses

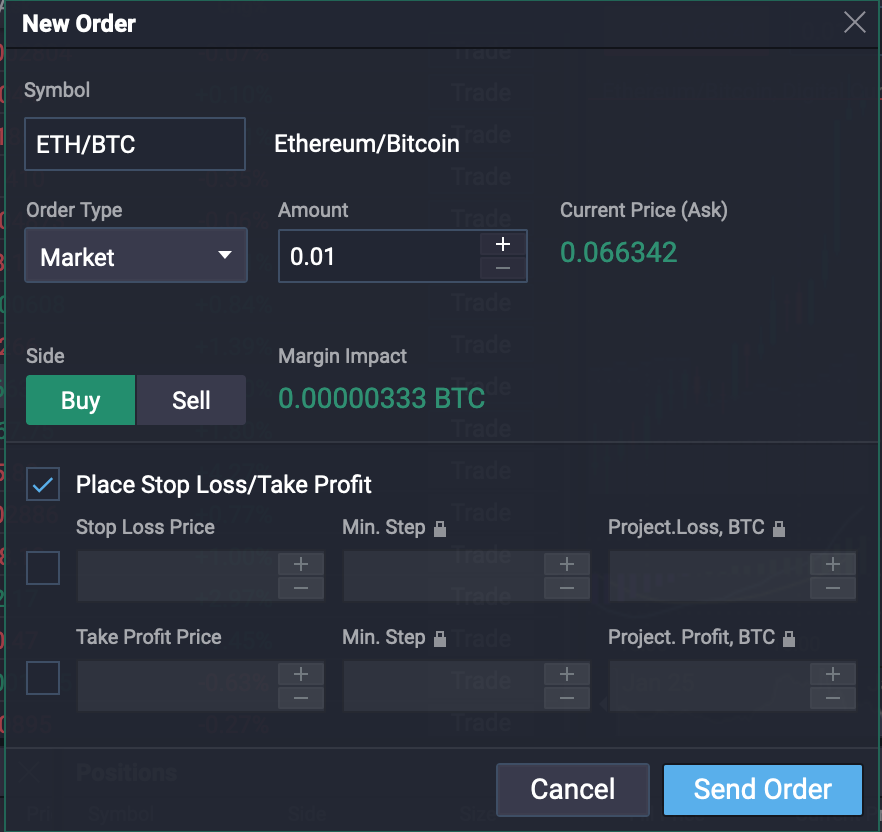

Stop-losses are perhaps the most effective tool in risk management when trading on leverage. A stop-loss closes your trade automatically when the price reaches a pre-specified level, allowing you to precisely determine your potential losses before even placing a trade.

Stop-losses should also be used in the calculation of your maximum position size for a trade. When the market hits your stop-loss and you get stopped out, the maximum loss should not exceed 2% of your trading account size.

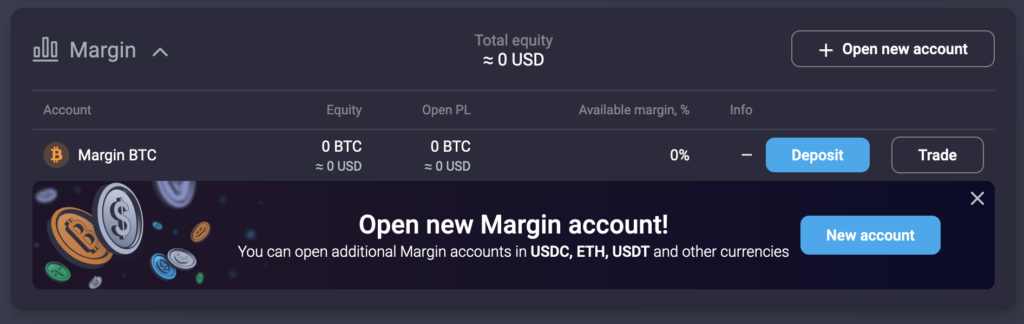

Why Margin Trading Bitcoin with FlowMarketPro?

FlowMarketPro is a leading provider of leveraged cryptocurrency products that allow you to take full advantage of margin trading. When used correctly, even a small price movement can amplify your potential profits and grow your trading account.

The award-winning trading platform behind FlowMarketPro provides you with all the tools you need to succeed in the crypto market. Whether you want to trade Bitcoin on leverage, profit from falling prices on Ethereum, or trade on stock indices, commodities, or forex – FlowMarketPro has got you covered.

- Magnified profits. For a fraction of the value of your trade, you can receive profits that are multiple times higher than those of an unleveraged trade. Plus, you can have a much higher market exposure compared to trading without leverage.

- Profit from falling prices. Whether markets are falling or rising, you can make a profit in the market. If you expect a market to fall, simply short the market and net the difference between the opening price and the closing price of your trade.

- Copy-trading. Trading can be a daunting experience for beginners in the market. With copy trading, you can follow the trades of other more experienced traders, and enjoy the results without having to analyze the market and trade yourself. You can first browse the profitability rates of trade leaders and their portfolios to see if their trading style and risk appetite is aligned with yours.

What Cryptocurrencies are available for trading in FlowMarketPro?

Besides stock indices, commodities, and Forex, FlowMarketPro offers an exhaustive list of the most liquid and popular cryptocurrencies in the market. They include heavyweights like Bitcoin, Ethereum, and Litecoin, but also Ripple, Polkadot, EOS, Cardano, Solana, Uniswap, Chainlink, and Dogecoin.

Those cryptocurrencies are extremely volatile which can lead to many profitable trading opportunities. It’s not uncommon for cryptocurrencies to fluctuate dozens of percentages in a single day or week.

Is crypto margin trading legal in the USA?

While cryptocurrencies are legal in the USA, trading CFDs is generally prohibited. You can buy and sell cryptocurrencies the same way as shares, but can’t trade them with CFDs and leverage in the USA.

Will a crypto margin call go away?

A margin call is a notification you may receive from your broker when your free margin falls below a certain threshold (usually below $0). When you receive a margin call, you should either deposit additional funds to increase your free margin or close some leveraged trade to free up the used margin in your account.

Can I buy crypto on margin?

Yes! FlowMarketPro allows you to buy and sell cryptocurrencies on margin with very attractive leverage ratios.

Which cryptocoin is best for margin trading?

The best coin for margin trading pretty much depends on your experience level and trading plan. Beginners usually find it easier to stick to the most liquid coins like Bitcoin and Ethereum. More experienced traders can put their hands on less-liquid coins as well.

Is margin trading the same as short selling?

Margin trading refers to trading on leverage, i.e. with borrowed funds. This allows you to significantly increase your market exposure and profit potential. Short-selling, on the other hand, allows you to profit from falling prices in the market. You can also short a market with leverage if you wish.