As the crypto market braced itself for the start of the 10-day ETH Merge upgrade, crypto prices sprang a surprise move to the upside on Monday after news of 6,003.59 BTC being removed from a crypto exchange broke, causing the price of BTC to briefly jump back above $20,000. Traders assumed that this could be a new whale purchase amid the dip in price, which helped the market start the new week on a positive note as the US stock market remained closed for a public holiday.

ETH fared even better as dip buyers rushed in to make last minute purchases of ETH hoping to get a forked PoW token. The ETH Merge would take place in two stages – the consensus layer upgrade would take place on September 06, while the main execution layer upgrade would take place around September 15. As traders were unsure if they would need to hold ETH in their wallets for both dates to get any fork token, many traders may have taken the weekend dip to buy some ETH, causing the price of ETH to rise by more than 5% last Monday to trade near $1,680.

Precarious Start Made Way to Cheers as BTC Leaped

However, the positivity was short-lived as the dump resumed after US stock markets returned on Tuesday.

More than $385 million in liquidations was seen between Tuesday and Wednesday as the price of BTC broke below $19,000. Of the total amount of liquidations, $250 million worth were in long positions.

The situation in crypto was made worse after Poolin, one of the world’s largest BTC mining pools, said that it was temporarily halting the withdrawal of BTC and ETH for its customers, citing it is facing liquidity problems. The move is reminiscent of various suspensions made by crypto wallets over the past couple of months, which eventually became bankruptcies.

However, the crypto market appears to be taking this negative news in its stride, as prices bounced very strongly between Thursday and Friday as the stock markets rebounded. For the first time in a month, the amount of short liquidations were far higher than long liquidations, with more than $300 million worth of shorts vs $90 million worth of longs liquidated as the price of BTC jumped 10% from $18,800 to above $21,000 in a day, led by rumours of another large BTC buy order being executed on one of the world’s largest crypto exchanges.

The two-way volatility gave traders much excitement in the lead up to this week as the market finally reached the epitome of the much-anticipated ETH upgrade. The positive sentiment from the end of last week has spilled over to the start of this week as traders expect a smooth ETH transition from PoW to PoS to give the crypto markets a boost, even as rumours of large BTC buyers are making the rounds.

BTC Hodler Amount Hits New ATH

These big BTC buyers, whoever they are or whether they exist, have so far saved BTC from breaking down into the bear flag formation that many crypto investors were worried about. While it is still unknown where this bounce could bring BTC to, at least for the moment, this bounce has opened the possibility of a potential BTC double bottom play on the weekly chart. While this does not mean that we are heading into a new bull market, a short to mid-term bounce should not be ruled out.

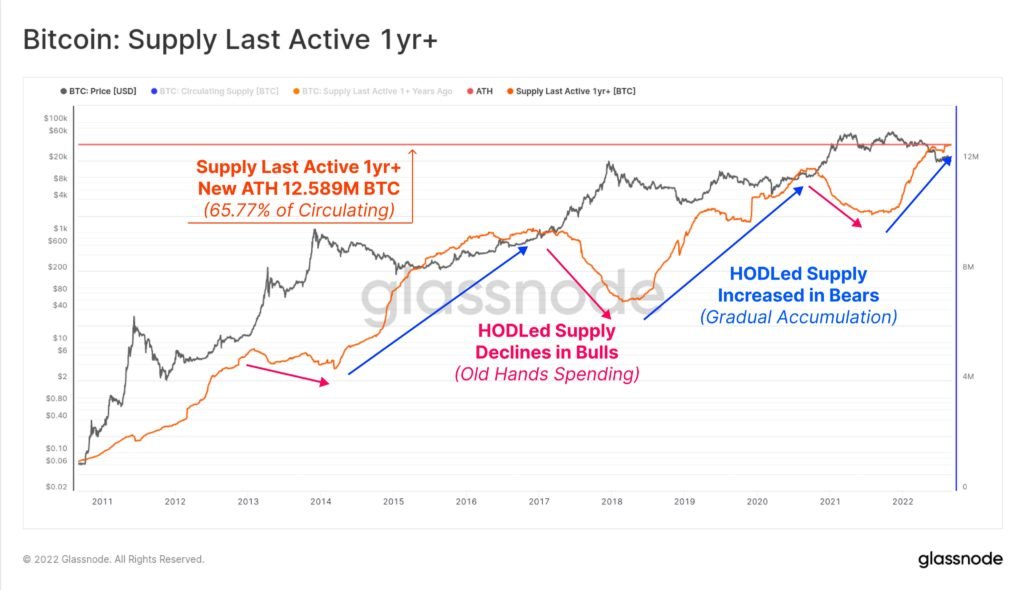

Other than the rumoured big BTC buyers, other BTC long-term hodlers have also been accumulating as they did during previous bear markets. BTC holders who have held their tokens for more than one-year continue to add, with the total number of BTC these wallets hold now reaching a new ATH of 12.589 million units of BTC, equivalent to 65.77% of the circulating supply. This is by far the highest level of concentration of BTC in hodlers hands, which is a positive sign.

Crypto starting to heat up

ETH Open Interest Surges Ahead of the Merge

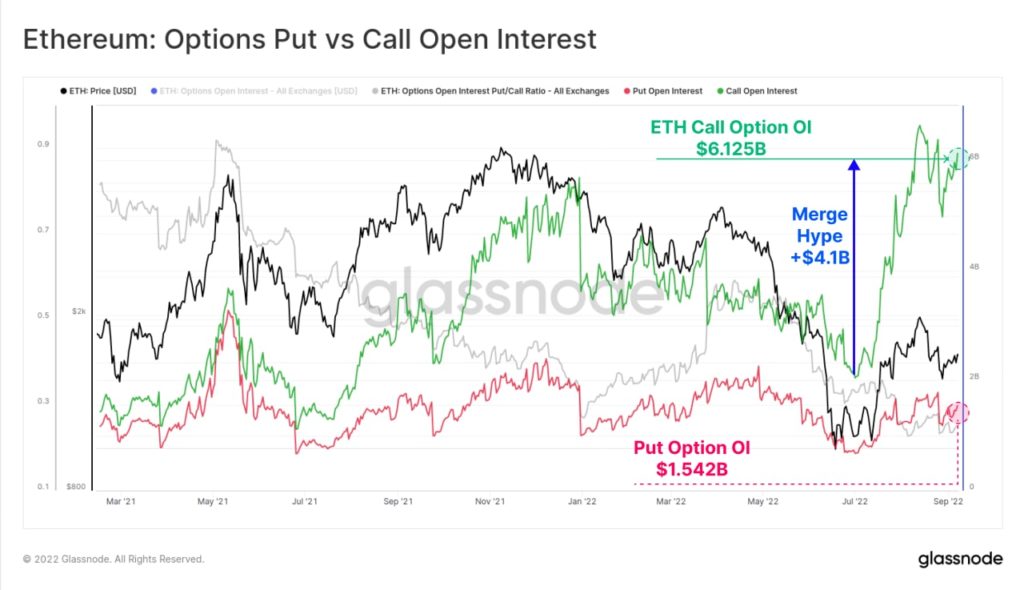

This week, attention could be centred on ETH as the Merge comes to fruition. Ahead of the big day, bullish speculative activity on ETH has risen sharply, with over $6.12 billion in outstanding Open Interest for Call Options, while Put options account for a much smaller $1.5 billion, making for a Put/Call Ratio of 0.25. With such a high Open Interest skewed to the bullish side, some market experts are worried that a negative surprise could spring up.

Forex Markets Action Packed

Even though the crypto market was rife with activity last week, action in the forex markets was even hotter, with at least 3 central banks seen raising key interest rates.

The ECB raised rates by 75-bps as expected by market participants, taking its benchmark deposit rate to 0.75%. The ECB had been keeping its rates in negative territory since 2014 so this rate increase was seen as being a significant shift in policy. The EUR/USD rose back above parity following the decision as investors expect the ECB to continue raising rates even though the policy board maintained that further rate increases would be data dependent. However, faced with strong economic headwinds, most experts do not expect strength in the Euro to be sustainable.

The ECB’s neighbour, the UK, saw the passing of their Queen Elizabeth II late on Thursday. As the nation mourned the death of the monarch, the GBP/USD recovered some early week losses which saw it fall to $1.1407, its lowest level against the dollar since 1985 after the appointment of new British Prime Minister Liz Truss. Investors are worried about the kind of policies that she would be implementing as the UK ushers in a period of record inflation and economic uncertainty. GBP/USD ended the week almost 1% higher at $1.1590.

The currencies of other Commonwealth nations like Australia and Canada also rose as traders paid tribute to the Queen. Their rises were not without other fundamental reasons as well, as the BOC raised rates by 75-bps while the RBA hiked rates by 50-bps in the same week.

Meanwhile, Fed Chairman Powell, in his last public appearance before the Fed meeting on 21 September, reiterated the Fed’s commitment to fighting inflation. Yields and the USD saw strong gains initially, but the gains tapered off as profit-taking ensued, with investors finally adjusting their expectations to account for higher rates in the days ahead.

A better-than-expected ISM Services index further showed that consumer spending was still not adversely impacted by the higher inflation, which led confidence to creep back into the markets. Better economic figures out of China also contributed to the renewed optimism. As a result, stocks and risky assets rose for the first time in 3 weeks, with the Dow adding 2.66%, the S&P 500 gaining 3.65% and the Nasdaq surging 4.14% higher.

Investor optimism was also in part due to lower oil prices, which had continued to fall for the second consecutive week. Oil started the week jumping almost 3% on Monday after OPEC+ members proposed a 100,000 per day production cut effective October. However, after Russia objected to the cut, oil prices gave back all those gains and slid even lower, with Brent losing 3.2% to close the week at $91.90, while the WTI lost 4.8% to close at $85.80. Both oil majors continue to build on the weakness from last week, opening the new week around 1.5% weaker at early Asian trading.

Gold remained flat, but Silver managed to eke out a gain of 4.4% last week and both precious metals are flat in the new week at the moment.

Most of the volatility came from the currency markets, as oversold conditions caused most currency majors to recoup losses against the USD. The USD/JPY saw volatility spike as it opened the week, surging almost 5% within two days, only to give back half of those gains after the BOJ governor said that the yen drop was too quick. However, most experts still expect the yen to weaken over the rest of the year as Japan remains the only nation with a free trading currency that is adopting a drastically different monetary policy as the rest of the world. While the others are tightening, Japan is still easing.

This week, the all-important CPI number out of the USA will be released. This will be the final set of economic data that the Fed will be watching to decide on how much to hike at the September 21 Fed Meeting. Expectations are for a 75-bps hike.

For the crypto market, other than watching the moves of the USD, eyes will also be on the final leg of the ETH merge, which is expected to take place on or around September 15. With such an exciting line-up this week, traders should have a lot of trading opportunities as two-way volatilities are expected.